As a loan officer, one of the most crucial aspects of your job is to generate leads. With the ever-evolving lending industry, finding new leads can be a challenging task. However, with the right approach and tools, you can increase your chances of reaching the right audience and closing more loans. In this article, we will discuss various ways to generate more loan leads in 2023. From cold-emailing and sales funnels to targeted advertising and retargeting, we will explore different strategies that can help you acquire new leads and grow your business. Whether you specialize in SBA loans, equipment financing, or any other type of loan, these strategies can help you reach the right audience and increase your chances of closing more loans.

B2B Cold Email Campaigns

Cold emailing can be an effective way to reach out to potential business loan leads. However, it’s important to make sure that your email is personalized and relevant to the recipient and that you are able to avoid the spam filters and reach your audience inbox. Some lenders successfully send millions of cold-emails every month and their entire lending business is based on reaching out to business owners by means of cold emails.

You have a vast pool of business owners in your database who could potentially benefit from a loan. While the list may not be completely up-to-date, it still represents a valuable opportunity to reach out to potential leads. One way to do this is through cold-emailing, but you can enhance that approach by targeting the same individuals with ads on various online platforms. This way, you increase the chances of reaching the right audience and closing more sales.

Business loan retargeting of audience lists is a powerful way for loan officers to reach out to potential leads who are on your email lists. Even if they are cold as cold can get. Retargeting is a form of online advertising that allows you to display ads to people by uploading their email addresses to a retargeting advertising platform. By creating retargeting lists based on specific loan types or industries, loan officers can increase their chances of reaching the right audience and closing more sales.

When creating a retargeting list, you can segment you audience based on different criteria such as:

Loan types: Segmenting the audience based on the loan types that they have shown an interest in. For example, if a potential lead has shown an interest in SBA loans, the loan officer can create a retargeting list specifically for SBA loans and target that audience with ads and information about SBA loans.

Industries: Segmenting the audience based on the industries they are in. For example, if a potential lead is from the manufacturing industry, loan officer can create a retargeting list specifically for manufacturing industry and target that audience with ads and information about loan options for manufacturing industry

Action taken: Segmenting the audience based on the actions they have taken on the website or ads. For example, if a potential lead has filled out a contact form or subscribed to a newsletter, the loan officer can create a retargeting list specifically for those leads and target them with ads and information about loan options.

Once the retargeting lists are created, you can then use these lists to display ads to your lists even if they are cold as ice. By creating retargeting lists, you can increase their chances of reaching the right audience and closing more loans.

B2B list retargeting can be done on a multitude of platforms. On Taboola for example, this would be called custom audience. Here is how to create Custom Audience from your email lists on Taboola:

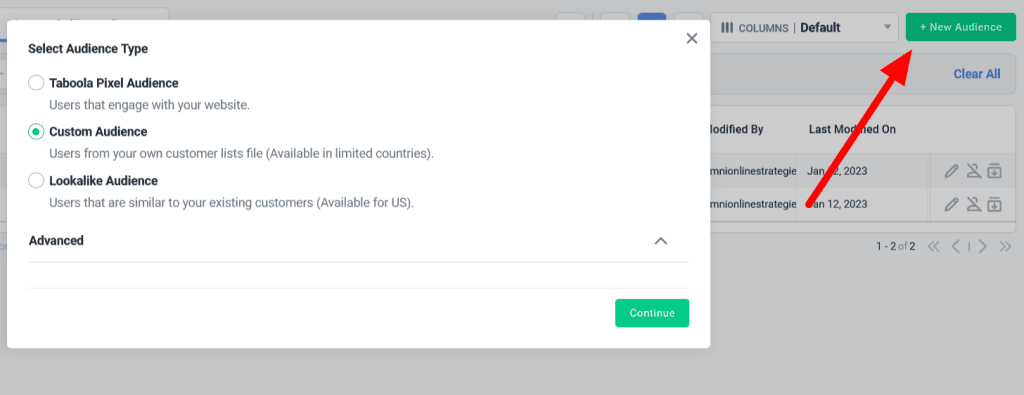

On your Taboola account, head to “Audience” and click “New Audience”. Then choose Custom Audience.

Name your list and upload your loan emails database. Taboola will build the retargeting list and will let you know how many people from your lists can be targeted.

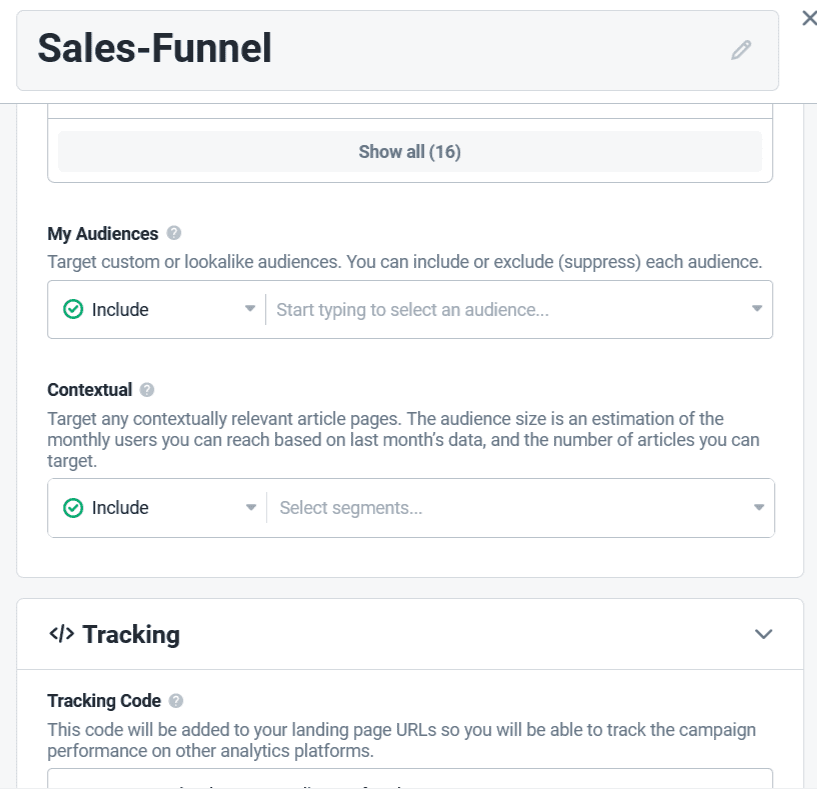

Head to campaigns and create a campaign. Choose the settings of your campaign and on “Audience Targeting”, under “My Audience”, find your load email list and select to target this list.